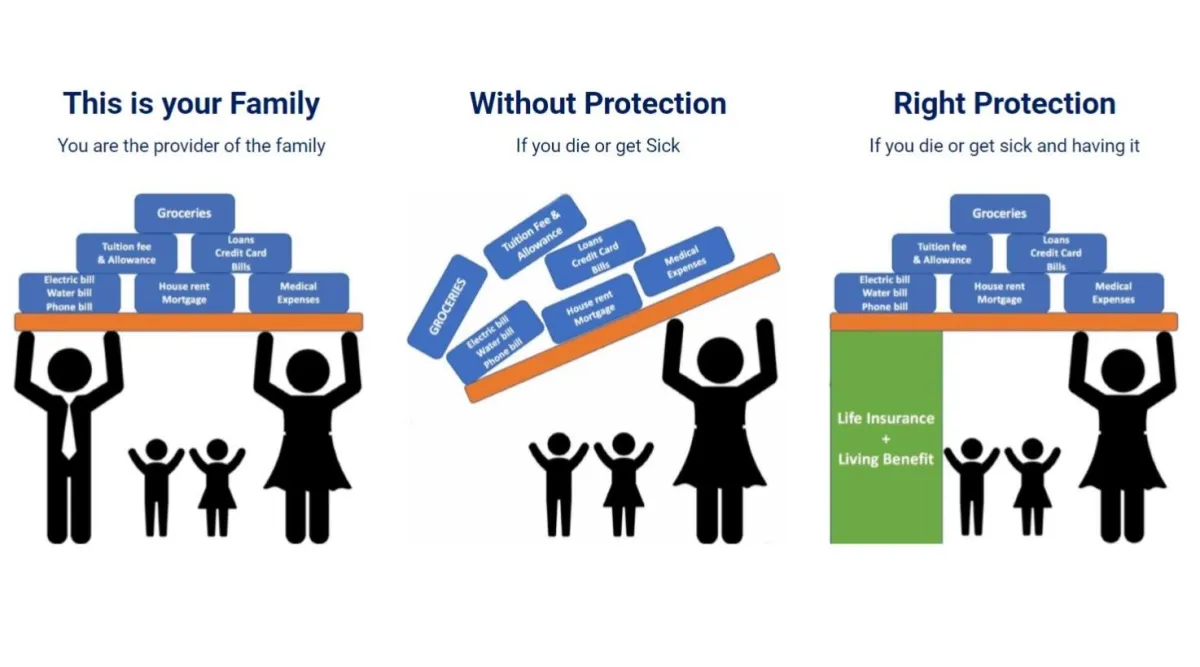

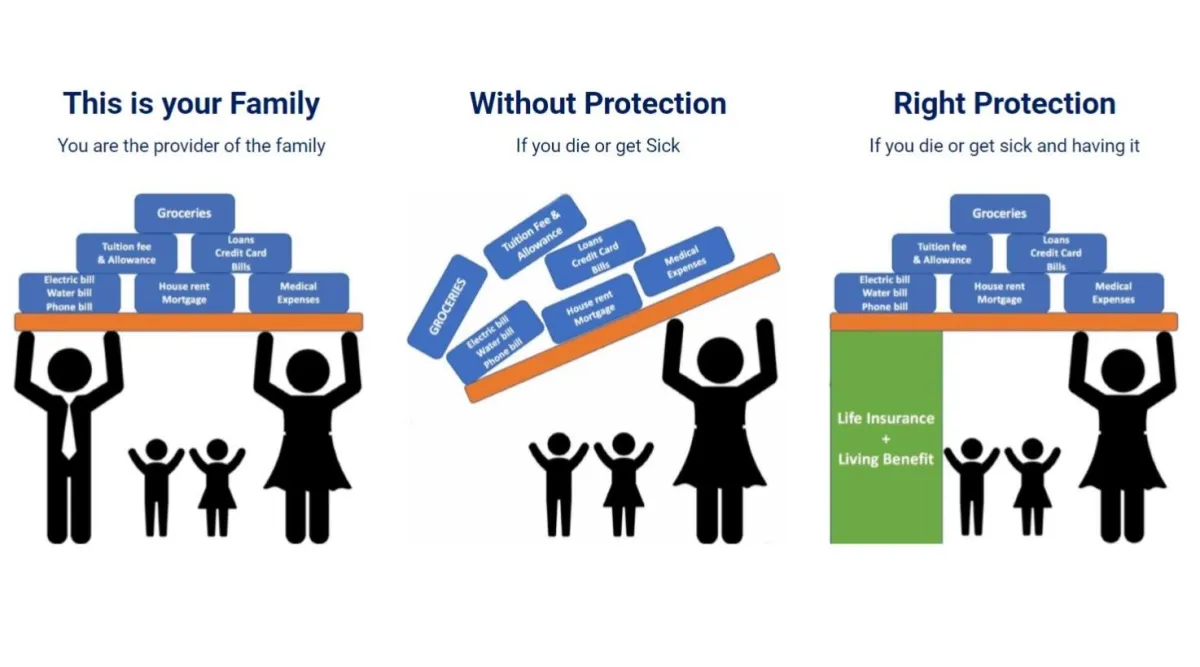

THE IMAGE DISPLAYED TO THE RIGHT CAN HAPPEN TO ANYONE...

Contrary to popular belief, Foreclosure is actually more common then one might think. A lot of Wealth is forfeited due to inadequate planning. Most equity & homes are dwindled in foreclosure because of some sort of untimely or unfortunate circumstance. Sudden Illness, death, disability to name a few...

Pictures with clients before the pandemic when we moved everything to virtual 😃

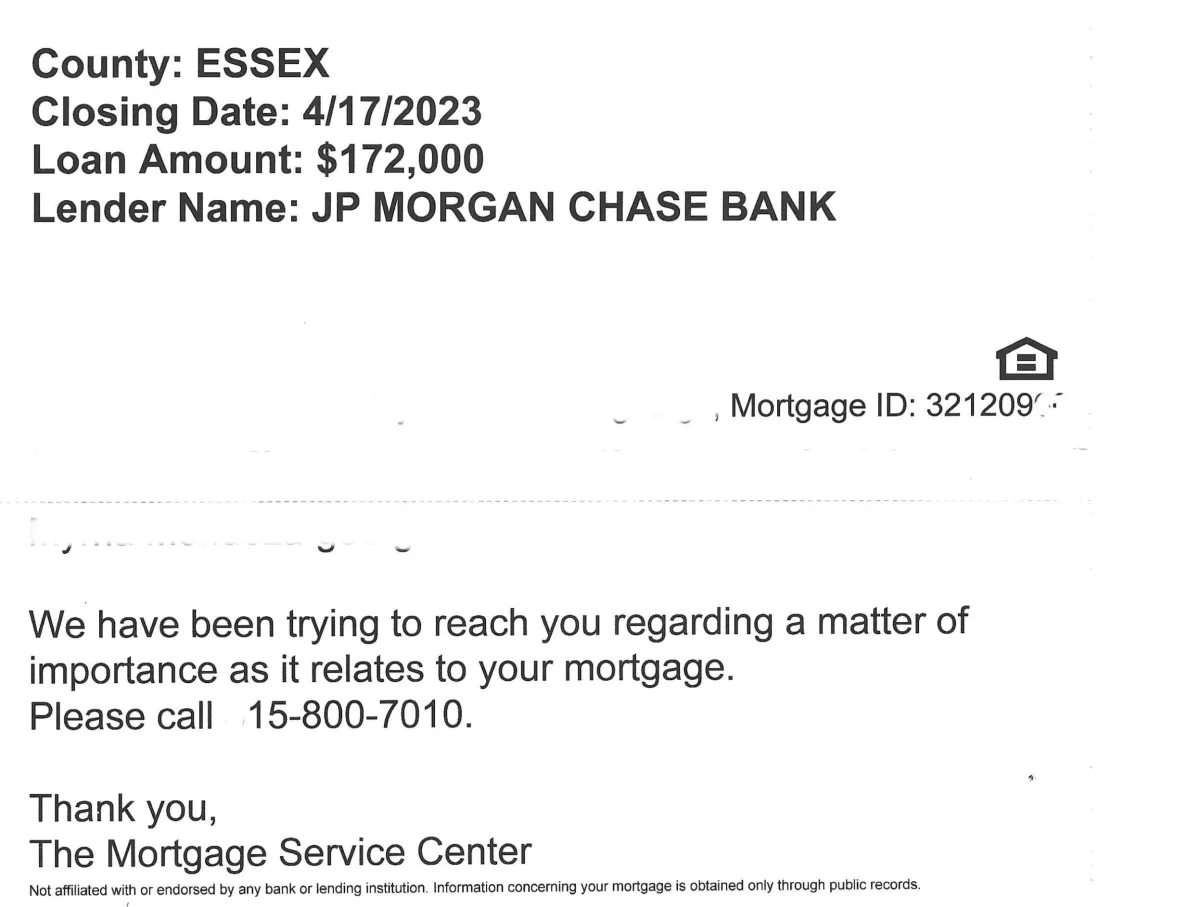

How the conversation started....

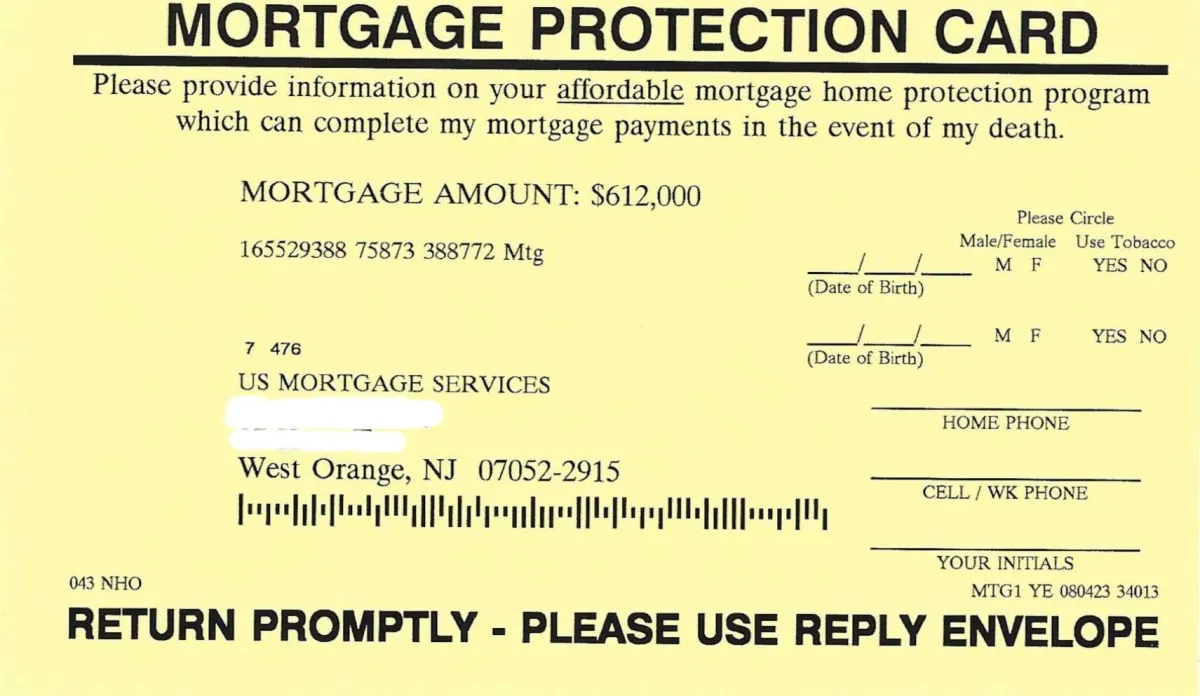

You may of purchased a home, Taken out a equity line of credit, Refinanced your mortgage or recently restructured your mortgage + home loan ....

And you responded to info in the mail regarding your mortgage

Protect YOUR Family as well as YOUR Most Valuable Asset 🏠

Peace of Mind that your family will Have a fully paid off mortgage Or Assistance to Continue to make payments under the toughest of circumstances

Customized and designed for each family, case by case.

What is Mortgage Protection Insurance (MPI)?

PROTECTS YOUR FAMILY IN ALL OF THE FOLLOWING:

Death

If You Pass Away

illness

Cancer, Stroke, Heart Attack, Major Disability ect.

Portable

Take It With You if You Refinance Or Sell

Live to long

Cash Back & Return Premiums Options

Our Partners

A Few of our Top A+ insurance companies accredited by the BBB

As seen on "The Balancing Act"

(Aired over 15 season since 2008)

Top Producing agent Steven Giordano who helps 1,000 families each calendar year explain to the host the importance of MPI

Protecting your family, in event of unexpected

- Helping you by -

Protecting what you worked so hard for. And Insuring your most valuable asset

Frequently Asked Questions!

DO YOU WORK MY 'XYZ' LENDER?

Offering products to most major lending institutions' databases throughout the country we are able to protect thousands of families per month company-wide & nationwide*

Remember, The banks specialize mainly in lending & banking programs. NOT INSURANCE.

If you qualify... your insurance protection is provided directly from an A+ rated insurance provider and owned independently by the policyholder (you)

This provides a sense of control to you as the homeowner making it so you would not have to fear losing your protection if you refinance your mortgage, relocate, or if your loan gets bought out by another lender.

Also, making sure you have access to the best available competitive programs in the marketplace

WHAT DOES FINAL NOTICE MEAN?

This Program could be purchased at a later date but may be significantly more expensive and include a more extensive underwriting process

its important for you to receive this information in a timely fashion!

I PURCHASED LIFE INSURANCE FOR $12 A MONTH THROUGH MY LENDER WHEN I GOT MY $250,000 MORTGAGE LOAN.

Here, you actually purchased an accidental death life insurance policy.

This type of mortgage protection life insurance will only protect your home if you died because of an accident. Any other type of death, such as disease or illness, will not be covered by this policy.

DO I HAVE TO INSURE MY ENTIRE HOME MORTGAGE?

No, you don’t.

It actually quite popular for spouses or partners to only ensure half or a partial amount of their mortgage. By doing so, this keeps the mortgage protection premiums low and affordable and allows the surviving spouse or partner to pay off half the mortgage and refinance the mortgage to cut their mortgage payments in half after a loved one dies.

Ideally, the objective is to have enough coverage in place that would allow you or your family CONTROL your asset (home) in the event of a unfortunate circumstance

I HAVE PRIVATE MORTGAGE INSURANCE (PMI) INCLUDED IN MY LOAN AND MORTGAGE PAYMENTS?

PMI ONLY protects the bank. Should you default on your loan; It helps them mitigate risk. it provides ZERO benefits to you & does not protect your spouse or loved ones should you die unexpectedly.

If you did not put 20% down on your home purchase when you financed your home, the lender would automatically makes you pay PMI until your mortgage balance is 80% of your home’s current value.

Private Mortgage Insurance (PMI) is not Mortgage Protection Insurance (MPI).

HOW MUCH DOES THIS COST?

Everybody is unique and is completely different. Health, Medication, Mortgage amount, term length. Plus there are a bunch of different options to cover a family (15 year, 30 year, cash back, even coverage you can pass down as an asset when house is paid off!) But, Typically on average we find policy holders pay premiums ranging anywhere between 40-90$ depending which option is the right fit

WHY WOULDN’T I JUST BUY MORE LIFE INSURANCE?

Mortgage protection is a form a life insurance provided through a A+ insurance carrier. So yes, You can increase your life insurance coverage, or just buy new insurance coverage

Regular Life insurance underwriting and approval on a fully underwritten policy (blood, urine, medical, height, weight, etc. exam) can take 6 to 8 weeks. They only include terminal illness riders which only accelerate benefits if you have 12 months or less to live.

Whereas Mortgage protection life policies are often approved within days. Mortgage protection policies also include other benefits such as living benefits not present in fully underwritten life insurance policies. These benefits allow you to take money out immediately from your insurance policy if you suffer from a heart attack, have a stroke, or get diagnosed with cancer

MPI provides you the flexibility of protecting your home mortgage loan in a separate policy from your life insurance policy. if house is paid off early you can always terminate coverage OR continue on with plan for something like income replacement or legacy/ estate purposes

WHY DID I RECIEVE SO MUCH MAIL?

A lot of times there are potentially duplicates that get sent out; Also other offices or agents could potentially be attempting to solicit! Once you go through the process this will dwindle down and cease

DOES MY BENEFICIARY HAVE TO USE THE BENEFITS TO PAY OFF THE MORTGAGE?

Good question. Absolutely not, the beneficiary will receive a death benefit proceed 100% tax free which can be used to pay off mortgage OR if the family wouldn't want to stay there with the sale of the home can be used with the equity to purchase a new one